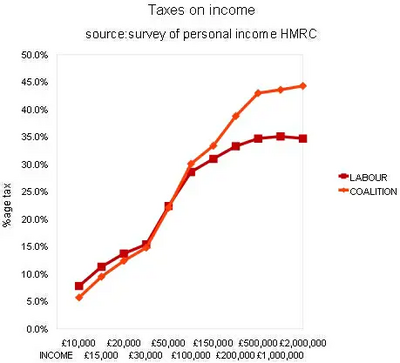

The Lower Paid Pay LESS Tax Under the Coalition than Under Labour and the Rich Pay MORE

The red line on the graph shows the Average Tax on Personal Income under Labour for 2009/10 at different Personal Income levels from £10,000 going up to £2,000,000.

The orange line shows the Average Tax on Personal Income under the Coalition for 2012/13 at different Personal Income levels from £10,000 going up to £2,000,000.

Notice how under the Coalition the lower paid are paying LESS tax this year than they did under Labour three years ago.

Notice too how under the Coalition the higher paid are paying MORE tax this year than they did under Labour three years ago.

Notice how the people in the middle are paying the SAME - so much for Labour's nonsense about the "squeezed middle"!

But notice also how under Labour the tax on Personal Incomes over a million pounds a year actually started to come DOWN again. The Coalition proportion continues to rise - but under Labour the very rich actually paid less tax the more they got!

And next year under Liberal Democrat tax plans the lower paid will pay even less - £600 a year less - and eventually the income tax on personal incomes below £10,000 will be ZERO.

The figures are from HMRC and I am indebted to Carl Minns of Hull for showing them in graphic form