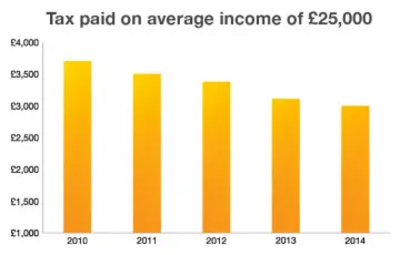

Thanks to the Liberal Democrats, 24 Million get a £700 Tax Cut

Starting this month 24 million people will receive a £700 tax cut compared to 2010. This will put £700 back in the pockets of the lowest earners.

Thanks to the Liberal Democrats, the new income tax personal allowance kicks in, reaching £10,000. It means 24m working people are paying £700 less in income tax than they were under Labour; people on the minimum wage have had the amount they pay in income tax more than halved; and 2.7m of people in the lowest paid jobs will no longer pay any income tax at all.

This was the top policy on the front of the 2010 Liberal Democrat manifesto and has now been delivered in full by the Liberal Democrats in Government. From next April, the personal allowance will rise again to £10,500, giving working people an £800 tax cut in total.

Speaking at the Welsh Liberal Democrat Conference in Newport last weekend, Nick Clegg said:

"From the previous Labour government we inherited an economy in crisis: spiralling debt, a record peace time deficit and a broken banking system.

"But by entering into Coalition we gave the country stable government.

"We stuck to our guns on our economic strategy, despite the pressure to change course.

"We made sure that this strategy is about more than just cuts. As important as it is to get the public finances under control, you also have to invest in the things that drive growth: record numbers of apprenticeships, billions of pounds to support businesses, unprecedented investment in Britain's roads and rail."

The Liberal Democrat policy is to continue to increase the threshold in the next Parliament to £12,500.

The Tories are keen to try and claim credit for our tax cut, but in reality they came into the election arguing for an inheritance tax cut for millionaires, which we blocked, and have argued in Government for a tax cut for some married couples and to reduce the top rate of tax